The American Institute of CPAs (AICPA) is voicing strong support for H.R. 4214, the Tax Deadline Simplification Act, cosponsored and introduced by Representatives Debra Lesko (R-AZ) and Bradley Schneider (D-IL).

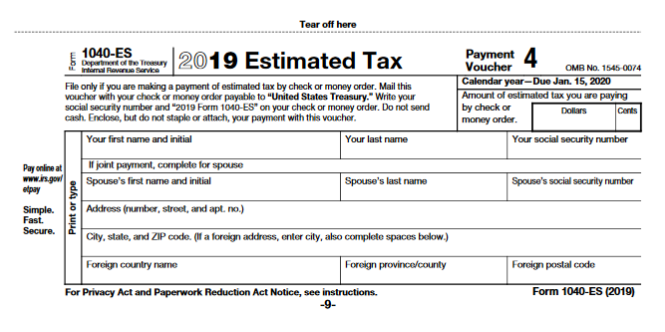

This bipartisan legislation will simplify the quarterly installments for estimated income tax payments by individuals, changing the due dates for the second and third quarter estimated federal income tax payments to have all quarterly payments due 15 days after the end of a quarter.

The AICPA has worked tirelessly over the last several months to secure relief for taxpayers who are subject to quarterly estimated tax payments. Currently, quarterly estimated payments for individuals are due on the 15th day of April, June, September and January, which does not align with a standard quarter and can be confusing to the growing number of self-employed individuals (and others). This creates unnecessary challenges for taxpayers to compute and submit timely payments.

“We appreciate and support Representatives Lesko and Schneider in their efforts to make it easier for taxpayers to meet their tax obligations,” said AICPA vice president of taxation, Edward Karl, CPA, CGMA. “The current structure can be confusing and can easily result in unintended mistakes – changing the dates as proposed in this bill is a commonsense approach that will allow for the flow of more accurate information to taxpayers.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs